Research reactors | Medical isotopes

Molybdenum-99 market supply and demand

1 January 2013Reliability of supply of medical isotopes has declined over the past decade due to unexpected or extended shutdowns at the few ageing Mo-99-producing research reactor and processing facilities. These shutdowns have created global supply shortages. Here, the OECD Nuclear Energy Agency (NEA) updates its 2011 report on the subject to reflect recent market changes, based on information from its High-level Group on the Security of Supply of Medical Radioisotopes (HLG-R) and other key stakeholders.

Medical diagnostic imaging techniques using technetium-99m account for roughly 80% of all nuclear medicine procedures, representing over 30 million examinations worldwide every year. Disruptions in the supply chain of these medical isotopes—which must be produced continually because they have half-lives of 66 hours (molybdenum-99) and six hours (daughter isotope technetium-99m)—can lead to cancellations or delays in important medical testing services.

In 2011, the NEA released reports about recent constraints in the supply chain, with an assessment of supply and demand to 2030 [1], and also an assessment of future demand for Mo-99/Tc-99m out to 2030 [2]. The future demand scenario was based on data from a global survey and an assessment of that data by an expert advisory group.

Since 2011, it has become clear that the current demand for Mo-99 is no longer 12,000 6-day curies per week (a 6-day curie is the measurement of the remaining radioactivity of Mo-99 six days after it leaves the processor’s facility (from end of processing). This reduction in demand stems from a number of changes that occurred as a result of the 2009-2010 supply shortages, including: better use of available Mo-99/Tc-99m, more efficient elution of Mo-99 generators, substitute diagnostic tests/isotopes, and so on. Based on current market practices, market participants have put the current demand at between 9500 and 10,000 6-day curies per week. The NEA has thus revised its demand scenarios to reflect the updated estimate of current demand as 10,000 6-day Mo-99 curies from processors. However, the NEA has maintained the expected demand growth rate out to 2030 presented in the 2011 study.

An additional change from the future demand scenario presented in [1] is the treatment of the need for outage reserve capacity (ORC). Outage reserve capacity is required to ensure a reliable supply chain by providing back-up irradiation and/or processing capacity that can be called upon in the event of an unexpected shutdown (see [2] for more information). This update treats ORC as effectively increasing demand for irradiation and processor capacity, as this capacity is required to be set aside in order to ensure security of supply. As a result, there is a range presented for demand based on the NEA demand study, from a situation where no ORC is demanded up to high ORC requirements (more information will be available in a forthcoming guidance document on ORC being developed by the NEA). This results in current demand with high ORC requirements being equal to approximately 13,300 6-day curies per week.

Since the publication of [1], the NEA has updated the list of current and new potential Mo-99 irradiation and processing projects. Based on the most recent information available, the update includes: revisions to production start/end dates, additional potential projects and impacts of converting to using low enriched uranium targets for Mo-99 production. The supply scenarios presented in this document use capacity and production numbers assuming that the target conversion plans of the various irradiators and processors proceed as expected. Once those facilities are converted, the capacity values used account for an expected reduction in capacity under the low-impact and high-impact scenarios used in the modelling of the impact of converting from high- to low-enriched uranium targets and associated processing. Where a shutdown is required for the conversion process, this has been included in the future scenarios (additional information on the impacts of target conversion is available in a forthcoming NEA report [3]).

Irradiation capacity

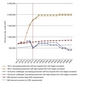

The current fleet of irradiators includes the following reactors: BR-2 (Belgium), HFR (Netherlands), LVR-15 (Czech Republic), MARIA (Poland), NRU (Canada), OPAL (Australia), OSIRIS (France), RA-3 (Brazil) and SAFARI-1 (South Africa). As has been pointed out in previous NEA studies, the current fleet of irradiators is ageing and many are expected to stop irradiating targets for Mo-99 production within the decade. It is clear that the expected exit of the NRU (capacity 200,000 6-day Ci/yr) and OSIRIS reactors (capacity 34,300 6-day Ci/yr), which today account for over a quarter of the available capacity, from the supply chain in 2016 and 2018 will drastically reduce the available capacity. In addition, the expected conversion to LEU targets in 2015 at most of the existing irradiators (all but OPAL, RA-3 and SAFARI-1 currently use HEU) will reduce available capacity from the current fleet. Within the ranges presented for supply and demand with the current fleet, shortages could be seen as early as 2016, or by 2019, depending on the actual impact of converting to LEU targets and the demand required.

It should be noted that the timelines for some current irradiators include an assumption that licence extensions will be provided. However, these licence extensions may require some refurbishments in the research reactor and the decision to proceed with those investments may be subject to the economic conditions that prevail in the market at that time. If the decision is to not proceed with the necessary refurbishments, the values in later years would be lower than presented. This highlights a key reason for the need to change the economic situation in the supply chain: to ensure the continued operation of current irradiators.

As is clear in Table 1, there are many potential irradiator projects at various stages of development. Some of these projects are very well advanced, while others are in the proposal or design phase or are seeking financing or other approvals before actually advancing to construction.

Figure 2: Current and potential new irradiator capacity vs. demand potential futures

Figure 2 presents two future situations for current and potential irradiator projects: an ‘all-in’ situation (which includes all current and potential projects) and an ‘economic challenges’ situation (explained below). For both of these scenarios, capacity is presented for high and low impacts from LEU target conversion. The ‘all-in’ situation appears to be very promising for future irradiation capacity, with available capacity being more than 300 percent of demand. However, that situation includes all potential projects that have been publicly announced without any validation or assessment of the likelihood of these projects actually being successful. As with all infrastructure development, not all of the projects that are planned will proceed. Many of the projects may not proceed as a result of the current economic situation in the Mo-99 supply chain, because of technological or regulatory challenges that hinder the development of the project or because of the increased competition that would result if all the projects were to enter the market. Recognising this reality, the second situation in the figure (‘economic challenges’) shows only those irradiation projects that can proceed in the absence of commercial funding. This situation is expected if the economic conditions in the Mo-99 supply chain do not improve from the current economically unsustainable situation that is described in previous NEA reports [1, 4].

It should be noted that, based on input from market participants (but so far without independent verification), the NEA understands that the uneconomic situation continues today. While some irradiators are moving to full cost-recovery (as indicated to be necessary for long-term supply security; for the full HLG-MR policy approach see [1]), it appears that others are not. It has been indicated to the NEA that prices for bulk Mo-99 in some cases have apparently declined to unsustainable levels since the shortage period. This past year there have already been two potential project cancellations that indicated that supply chain economics and the related business case were not sufficient to proceed at this time: the GE-Hitachi project and the Dedicated Isotope Production Reactor (DIPR) in South Africa.

Figure 1: Current irradiator capacity v.s demand potential

Under the ‘economic challenges’ scenario only the following irradiation sources are included: current reactors, FRM-II, INR, RIAR, KOREA, Chinese Advanced RR, BMR, and RA-10. The NEA also modelled a ‘technology challenges’ scenario, where new technologies and new projects face a higher risk and thus some do not proceed. In this scenario, supply was greater than demand over the entire period.

The two scenarios presented in Figure 1 represent possible extremes in the future supply of Mo-99. The ‘all-in’ may be optimistic and the ‘economic challenges’ pessimistic. However, they are provided to illustrate the range of possible outcomes and, again, emphasise that the market does need to change to a sustainable economic structure to ensure supply reliability for the long term. Figure 1 shows that if the economic situation in the supply chain does not improve, the global supply chain will be facing long-term shortages of irradiation capacity as early as 2023, and definitely by 2026, depending on the actual demand within the possible range. This reiterates the concern of previous reports that the very positive outlook of the ‘all-in’ situation hides a possible reality of long-term shortages as a result of the underlying unsustainable economic model of the supply chain.

Processor production

While irradiation capacity is essential for Mo-99 production, the future supply and demand scenarios for processor production are more indicative of potential supply, as they recognise the necessary coupling of irradiation and processing infrastructure; where one is available without the other, the potential capacity cannot be used. This was the case in the 2009-2010 shortages, when processing capacity in Canada could not be used as the NRU reactor in Canada was shut down, and at the same time available irradiator capacity in Europe could not be completely used as there was not sufficient processing capacity to offset the production losses in Canada.

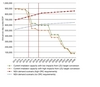

The current fleet of processors includes AECL/NORDION (Canada), ANSTO HEALTH (Australia), CNEA (Argentina), COVIDIEN (USA), IRE?(Belgium), NTP (South Africa). While processing capacity seems to be sufficient out to 2030 under all situations, processing production is not sufficient under some of the situations modelled. Two principal reasons for this insufficiency are the lack of sufficient irradiator capacity under certain situations and regional limitations of processors in relation to the location of new irradiation capacity.

The supply of bulk Mo-99 from current processors is predicted to be insufficient from 2017 onwards. This long-term shortfall is a result of insufficient irradiator and related processing capacity from the current fleet. This situation assumes that new irradiator capacity comes on line, but current processing capacity is insufficient to be able to use the increased irradiator capacity when location requirements are taken into account. Even under a hypothetical situation of no LEU target conversion, long-term shortfalls could occur from 2017 onwards. This demonstrates the fact that the major concern related to long-term Mo-99/Tc-99m supply security is not principally related to LEU target conversion but rather to the underlying economic problems in the supply chain that hinder new infrastructure investment.

Figure 3 presents the two future scenarios, ‘all-in’ and ‘economic challenges’ situations, for current and potential processing projects. For both of these scenarios, production is presented accounting for high and low expected impacts from LEU target conversion. The ‘all-in’ situation for potential processor production, as with irradiation capacity, appears to be very promising for long-term supply security, but is probably over-optimistic. The second situation presented is the ‘economic challenges’ situation, which again shows only those projects that can proceed in the absence of commercial funding, both irradiation (discussed in the previous section) and processing projects. This situation shows the potentially available supply of bulk Mo-99 if the economic conditions in the supply chain do not improve from their current condition [1, 4]. Recognising the economic situation that reportedly exists today, this ‘economic challenges’ situation appears to be a serious possible future outcome.

Figure 3 shows that if the economic situation does not improve, the global supply chain could be facing long-term supply shortages by 2026. Shortages could arrive earlier (2017) under demand with a high outage reserve capacity requirement. It must be noted that under an ‘economic challenges’ situation where future LEU target conversion does not occur, there is still a potential shortage expected in 2017 but the supply of bulk Mo-99 then increases above the high ORC demand curve until 2026. Under this situation, definite long-term shortages occur in 2027, when the no-conversion scenario drops below the no ORC demand curve. The NEA also modelled a ‘technology challenges’ scenario, where new technologies and new projects face a higher risk and thus some do not proceed. Under this scenario, supply was greater than demand over the entire time period, with two tight periods around 2014 and 2017.

Conclusion

This presentation of supply and demand future scenarios for the Mo-99 market revises previous NEA future scenarios based on new data and target conversion commitments from the supply chain. The update, unfortunately, does not present a more optimistic future scenario than previous presentations; the concern around the uneconomic situation of the supply chain continues to dominate the potential for new projects. This results in the potential for long-term shortages within the decade.

Author Info:

This article is an edited version of ‘A Supply and Demand Update of the Molybdenum-99 Market,’ OECD/NEA, Paris, August 2012, reproduced with permission.

Related Articles

Reactor conversion

Box: Australia greenlights ‘Mega Moly’ project

South Africa's Safari 1 wins $25 million isotope contract

IAEA secures medical isotope supply

US, Belgium, France and the Netherlands announce pact to reduce use of HEU for isotope production