Power market developments

Ontario's nuclear future

28 July 2006The government of Ontario has confirmed it is committed to an ongoing nuclear programme and has acknowledged that nuclear power is and will be an essential part of the electricity mix. Now that this decision has been taken, the real work can begin. By Milton Caplan

After six months of review and public consultation, Dwight Duncan, the Ontario minister of energy has responded to the ‘advice’ given to him by the Ontario Power Authority (OPA) last December. And in that response, he has directed the OPA to move forward with the development of their comprehensive 20 year supply plan, the Integrated System Power Plan (IPSP), based on this advice with some revisions. He has also confirmed that nuclear power will continue to be the backbone of the Ontario electricity system. As Canada continues down the path of its nuclear future, there remains much hard work to be done to ensure that this plan becomes a reality.

It is now two years since the energy minister announced: “After more than a decade of mismanagement in Ontario’s electricity sector, our ability to keep the lights on has been compromised. It is absolutely critical that we move forward quickly to boost new supply, increase conservation and maintain price stability for consumers so that we can ensure continued prosperity in the province.”

Ontario had an ageing electricity supply and distribution system, a market that was not working and its major generating company, Ontario Power Generation (OPG) was suffering from years of ineffective restructuring and political uncertainty. To add to the problem, the Ontario government made a pledge to replace all of the coal generation in Ontario, representing close to 25% of the supply with more environmentally acceptable alternative generation. This, coupled with a nuclear fleet that was nearing its end of life, made it clear that the electricity sector in Ontario was in crisis.

As stated by the Ministry of Energy: “Ontario needs to refurbish, rebuild, replace or conserve 25,000 megawatts of generating capacity by the year 2020 to meet growing demand while replacing its polluting coal-fired generating plants. That represents 80% of Ontario’s current generating capacity and would require an investment of $25 to $40 billion.”

The government has taken action to address this critical issue, making announcements almost continuously over the past two years related to the electricity sector. This new direction resulted in a strong commitment to conservation, the announcement of numerous initiatives to increase supply and a complete restructuring of the electricity sector through the introduction and passage of Bill 100.

Bill 100 reorganised the sector with one of its key outputs, the creation of the OPA, to act as a central planning authority for the province, and to contract for generation if and when needed. The objective was to create a new hybrid electricity market, partly regulated and partly open to market forces.

Looking to the future, the government wanted to create a conservation culture and increase the use of renewables while meeting its commitment to remove coal generation from the mix based on its environmental and health impacts. Given this strong commitment to removing coal, representing almost a quarter of the generation in Ontario, by 2007, the first task was to ensure that the lights stay on in the short to medium term.

MEETING SHORT-TERM NEEDS

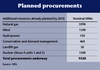

To meet this challenge, the Ontario government, now through the OPA, went on a huge offensive, making a number of new procurement commitments to enable the system to operate until about 2015. Currently there are initiatives in place for about 9500MWe of new capacity. These include contracts for significant wind generation and other renewables supply, new gas generation, conservation and demand management and the refurbishment of idled nuclear units. The Table shows the list of planned procurement projects by fuel type.

Progress on these procurement initiatives continues to be made. More than half of these procurements are contracted and most of the remainder is in the RFP (request for proposal) stage. While there may be some risk that the entire amount will not be achieved on schedule, the programme’s successes continue to enable the province to meet demand. Last summer, on 13 July 2005, a new peak demand of 26,160MWe was achieved. While the supply was tenuous, demand continued to be met.

The most recent 18-month outlook issued by the Independent Electricity System Operator (IESO), for the period from April 2006 until September 2007, shows an improved outlook compared to last summer. Supply is expected to meet demand for the normal weather scenario, due to the addition of some of these projects. This is a direct result of the addition to the system of Pickering 1 at 515MWe, the Greater Toronto Airport Authority gas fired cogeneration unit at 117MWe and to 200MWe of new wind power (although the IESO assumes that only 10% of this value is available for peak). In the case of an extreme weather scenario, demand would have to be met with a continuing contribution from imports.

PLAN TO REPLACE COAL

Based on the above procurement initiatives, the government announced its detailed plan to replace coal in June of last year. This plan had some delay from the original promise, with the last units at Nanticoke being retired in 2009 rather than in 2007.

While having some early success with the closure of the Lakeview generating station on schedule in 2005, a number of recent events have forced the government to further delay this plan.

In June of this year, the IESO released its updated reliability outlook. In this report, it has revised its planning assumptions, the results of which have had a significant impact on the peak demand resource requirements. Changes to assumptions regarding the peak demand forecast and the available supply from hydraulic resources at peak, have led to a requirement for an additional 2500 to 3000MWe requirement to maintain the reliability of the system.

In addition, delays in approvals for new gas generation and transmission projects will result in delays in the shutdown of some coal units. The new gas projects are now expected to be completed 18 months to 2 years behind schedule. And finally, the government has recently cancelled a project to convert the Thunder Bay units to gas.

Given the magnitude of these changes on the plan to replace coal, the minister had no choice but to revisit the plan once again, and has now put the question back to the OPA asking it “to develop a revised plan for replacing coal-fired generation in the earliest practical timeframe without compromising reliability. The OPA is also being asked to recommend cost-effective measures to reduce air emissions from coal-fired generation.”

OPA 'ADVICE'

With the short- to medium-term procurements underway, planning was able to begin to address the longer-term issues. In June 2005, the minister requested that the OPA prepare an ‘advice’ on the future supply mix making recommendations with respect to conservation targets, targets for the addition of renewable energy sources and with respect to the appropriate mix of electricity supply for the balance of system.

This report was completed in December 2005 and made recommendations to the minister that would “increase in the share of renewable sources in Ontario’s supply mix, maintain the share of nuclear generation, and replace coal by increasing the share of gas-fired generation and renewable resources.”

The report demonstrates that the current procurement plans in place will enable the system to operate until about 2015. Therefore, the focus of the report is to determine “the best way to meet the needs over the long term, specifically by 2015, 2020 and 2025.” Figure 1 shows the nature of the growing gap so that there would be shortfall of about 15,000MWe by 2025.

No single resource would be better than others in all areas, addressing environmental, reliability and cost requirements, as well as meeting the needs of baseload, intermediate load and peaking capacity. Therefore a combination of resources must be considered to meet the needs of all of Ontario.

By emphasising the preference for conservation and the use of renewable energy technologies, the report concludes: “Together, conservation and new renewable resources would more than meet all of Ontario’s growth in demand for electricity by 2025. This would not, however, replace the loss of capacity from the retirement of other supply sources.”

Therefore, more conventional generation technologies were also considered to make up the balance of the requirement. Given the desire to remove coal generation from the mix, the remaining technologies generally available today are gas fired generation and nuclear power.

While gas is a very attractive option for a number of reasons, both technically and environmentally, the recent increases in the price of gas as well as its price volatility make it more suitable to peaking loads. This leaves nuclear power as the remaining option. Its high capital and low operating cost characteristics make it a very suitable solution to meet baseload requirements.

After considerable analysis, the OPA recommended the scenario shown in Figure 2.

The ‘advice’ provided to the minister is indeed just that, an advice. On 13 June 2006, the minister responded to this advice and directed the OPA to proceed with the preparation of its Integrated Power Supply Plan (IPSP) on the basis of its advice. This IPSP will be a comprehensive 20-year supply plan that will be reviewed and updated every three years. This plan will be submitted to the Ontario Energy Board (OEB) for review and approval and will include an opportunity for public comment. The OPA had its official launch of the IPSP process on 29 June and expects to submit the plan to the OEB in March 2007.

The government also directed the OPA to put more emphasis on conservation, doubling its target relative to the OPA advice. This would have the impact of reducing the need for gas generation and limiting the nuclear share to the same as it is today on an installed capacity basis (see Figure 2).

THE ROLE OF NUCLEAR

So what does all of this mean for the future of nuclear power in Ontario?

Nuclear power continues to be the backbone of the Ontario electricity system. In recent years, the return to service of Pickering 1&4 and Bruce 3&4 (approximately 2500MWe) has been an important element of the system being able to continue to meet demand.

The conclusion of the OPA advice is that by 2025, the share of nuclear on an energy basis should remain about the same as it is today. This can be achieved through “refurbishing existing units, rebuilding on existing sites and undertaking ‘new build’ plants.”

While nuclear power does have its critics and there have been problems associated with this form of generation in Canada in the past, the Ontario government and the OPA now also see its benefits. The key benefits are:

- Nuclear power provides environmental benefits in that it does not emit greenhouse gases, and there has been progress on the issue of nuclear waste by the Nuclear Waste Management Organization.

- Well-managed nuclear continues to be a low-cost option relative to others; the technology is proven and both Bruce Power and OPG now have extensive experience in the successful management of the technology.

- There has been recent successes in delivering projects on time and on budget.

- The fuel source is indigenous, supporting security of supply.

The current fleet of nuclear reactors in Ontario are ageing and are nearing their natural end of life. Figure 3 shows that the currently operating units start to drop off towards the end of the 10-year period and, within 20 years, most of the fleet will have to be replaced. However, the current fleet of nuclear reactors have the ability to be refurbished and have their lives extended by another 25 to 30 years. Pickering units 4 and 1 have already been restarted and the refurbishment of the four units at Bruce A is underway. The success of this project will set the path for an ongoing refurbishment programme for the entire fleet.

MAKING IT HAPPEN

The advice concludes with a list of ten action items to move forward with the plan. Of relevance to nuclear are actions 8 and 9 which read as follows:

8. Investigate the potential to refurbish existing nuclear units. Begin this immediately because the scope is complex and requires extensive planning and coordinating.

- Coordinate other resource availability to ensure adequate supply during the periods of nuclear refurbishment.

- Define a process that enables new nuclear development as early as possible, with scope to include proponent, site, technology and environmental assessment.

REFURBISHMENT

Since the OPA recommendation is to maintain nuclear power at its current level of generation, the primary issue is that the current nuclear fleet is ageing and approaching its end of life. The report states that the nuclear capacity “should be achieved through at least the refurbishments of currently operating units, where it is economic, or replacement where it is not economic. Additional new capacity, beyond replacement, will also be required in certain scenarios.” Therefore, should it be possible to refurbish and life extend the current fleet, the pressure for new build will be reduced and Ontario will be able to maximise the benefits from the existing asset base.

Assumptions in the advice demonstrate that the economics of refurbishment are expected to be better than for new build plants. And of course, a refurbishment of an existing unit would require a shutdown of between one and two years, while a new build would take of the order of eight to ten years to complete.

While two Pickering units and two Bruce units have been restarted, there is little experience with a large-scale refurbishment required to life extend the fleet. The Bruce 1&2 project will be the largest and first major refurbishment of its kind. Now that the Bruce A plant refurbishment is committed, it is essential that this project be successful – that is, on time and on budget – in order to build confidence to secure approvals to enable the refurbishment of the remainder of the fleet.

The advice is somewhat conservative in its assumptions for the cost of refurbishment. It is assumed that all future refurbishments would cost the same as the Bruce 1& 2 project. In reality, there are a number of reasons why subsequent projects should show reduced costs. For example, the Bruce units have been shut down with their fuel removed for close to a decade (and in the case of Bruce 2, even longer). Therefore, there is more work required to bring these units back online than would be expected for a unit that is in operation immediately prior to its refurbishment. These are also the first projects of their type. There can be an expectation of achieving some benefits as experience is gained and the next projects move down the learning curve.

Therefore, with proper planning, it should be expected that following the Bruce A station, that Bruce B, Darlington and Pickering B would also be refurbished. Planning for future refurbishments should focus on continued process improvement, with emphasis on bringing down the costs and reducing the risks to completion.

NEW BUILD

The minister’s directive to the OPA was to limit the nuclear capacity to be the same as it is today at 14,000MWe. Therefore, given that OPG has already taken a decision not to restart Pickering 2&3, there would be a need to construct a minimum of 1000MWe of new build. The OPA advice does allow for the fact that it may be more advantageous in some circumstances to build new rather than refurbish, noting: “In the case of refurbishment, the extent of the work may, in some cases, amount to essentially building most of a new unit in the place of the old one. This provides Ontario with the opportunity to take advantage of changes in nuclear technology that may be simpler to operate, cheaper to run and better performing.”

Assuming that the first tranche of new build would be required soon after 2015 as the gap starts to develop in the system, then consideration to new nuclear build would have to start now. Nuclear plants have very long lead times and can require from eight to ten years from conception to operation.

In his comments to the Canadian Nuclear Association in February, Jan Carr, the CEO of the OPA, gave his thoughts as to how the procurement for nuclear new build may proceed. Recognising the long lead times to implement a new build nuclear project, the OPA is willing to start the process and take decisions that will give Ontario the option of proceeding with construction sometime in the future. This means embarking upon the upfront approvals required for new nuclear construction. Jan Carr was also clear in that it is not the responsibility of the OPA to provide guidance on the choice of technology for Ontario, nor on who will build, own or operate these new units.

The minister has outlined the key principles that will govern the decision on new build nuclear. These include: a willing community and appropriate site, a fixed price with performance guarantees, a turnkey agreement to limit the risk of cost overruns and cost effectiveness over refurbishment.

Given the time required to bring a new plant into production, the government has directed OPG to begin the work necessary to enter into an approvals process, including the environmental assessment, for new units to be built at an existing facility. And while there is no clear procurement process yet determined for new build, the government has provided some indication on how it would like to proceed by stating that it prefers to use Canadian companies and technology. But it also states that its obligation is to the people of Ontario and “decisions will be made on the best technology offered at the best price to Ontario ratepayers.”

Author Info:

Milton Caplan, President, MZConsulting Inc., 377 Ridelle Ave, #217, Toronto, Ontario M6B 1K2, Canada

Related ArticlesHow to replace coal Nuclear: necessary Designs on Ontario Ontario announces nuclear plan Ontario's nuclear revival Ontario backs replacing nuclear Pickering reactor overhaul abandoned on cost grounds Ontario energy report calls for replacement nuclearFilesFigure 1: Gap in 2025 after procurements Figure 2: Installed capacity (MWe), OPA advice (left) and government response Figure 3: Planning assumptions regarding nuclear end-of-service dates