Duke Energy and Progress Energy, Inc. have said that both companies’ boards of directors have unanimously approved a definitive merger agreement to combine the two companies in a stock-for-stock transaction.

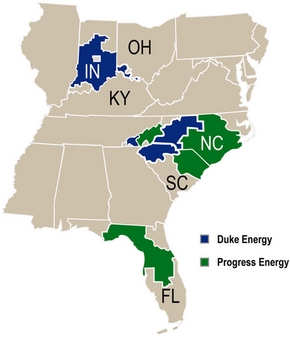

The combined company, to be called Duke Energy, will be the country’s largest utility. It will have the country’s largest regulated customer base, providing service to approximately 7.1 million electric customers in six regulated service territories: North Carolina, South Carolina, Florida, Indiana, Kentucky and Ohio. It will have approximately 57 gigawatts of domestic generating capacity from a diversified mix of coal, nuclear, natural gas, oil and renewable resources.

The combined company also claims to have the largest regulated nuclear fleet in the country. Duke has seven commercial reactors at three plants totalliing 7365MWe current gross : Catawba 1&2, McGuire 1&2 and Oconee 1-3. Progress runs five reactors at four sites totalling 4575MWe current gross: Brunswick 1&2, Crystal River, Harris and Robinson. Of the above reactors, only Brunswick 1&2 are BWRs. With a total nuclear capacity of 11,940MWe current gross, the new company just beats Entergy (11,543) to second-largest US nuclear utility after Exelon (18284).

“Our industry is entering a building phase where we must invest in an array of new technologies to reduce our environmental footprints and become more efficient,” said Jim Rogers, chairman, president and chief executive officer of Duke Energy. “By merging our companies, we can do that more economically for our customers, improve shareholder value and continue to grow.

“Combining Duke Energy and Progress Energy creates a utility with greater financial strength and enhanced ability to meet our challenges head-on,” Rogers continued.

Under the merger agreement, Progress Energy’s shareholders will receive 2.6125 shares of common stock of Duke Energy in exchange for each share of Progress Energy common stock. Based on Duke Energy’s closing share price on Jan. 7, 2011, Progress Energy shareholders would receive a value of $46.48 per share, or $13.7 billion in total equity value.

Duke Energy also will assume approximately $12.2 billion in Progress Energy net debt.

Following completion of the merger, officials anticipate Duke Energy shareholders will own approximately 63 percent of the combined company and Progress Energy shareholders will own approximately 37 percent on a fully diluted basis.

When the merger is completed, Rogers will become executive chairman of the new organization. In this role, Rogers will advise the CEO on strategic matters, play an active role in government relations and serve as the company’s lead spokesperson on energy policy.

Bill Johnson, chairman, president and chief executive officer of Progress Energy will become president and chief executive officer of the new company.

Both Rogers and Johnson will serve on the board of directors of the combined company, which will be composed of 18 members, with 11 designated by Duke Energy’s board of directors and seven designated by Progress Energy’s board of directors.

The combined company will be headquartered in Charlotte and will maintain substantial operations in Raleigh.

Until the merger has received all necessary approvals and has closed, the companies will continue to operate as separate entities.

Completion of the merger is conditioned upon, among other things, the approval of the shareholders of both companies, as well as expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Other necessary regulatory filings include: Federal Energy Regulatory Commission (FERC), Nuclear Regulatory Commission (NRC), North Carolina Utilities Commission (NCUC) and South Carolina Public Service Commission (SCPSC).

The companies also will provide information regarding the merger to their other state regulators: the Florida Public Service Commission, Indiana Utility Regulatory Commission, Kentucky Public Service Commission and Ohio Public Utilities Commission.

The companies are targeting a closing by the end of 2011.