Hydrogen

Beyond electricity

10 August 2009US utility Entergy recently finished an economic analysis of using an HTGR (to be developed through the USA’s next-generation nuclear programme) to generate hydrogen and process heat, and also electricity. Its surprising results have forced a change in the direction of its plans. Will Dalrymple reports.

Entergy’s stake in nuclear reactors for power generation dates back to a strategic decision in 1997, says Dan Keuter, Entergy Nuclear vice president of planning and innovation. Entergy is the second-largest nuclear generator in North America operating facilities that power more than 10 million homes in the U.S. states of Arkansas, Louisiana, Massachusetts, Michigan, Mississippi, Nebraska, New York and Vermont.

In the near term, the company is focusing on advanced light water reactors (ALWR), and was instrumental in forming an industry alliance, NuStart Energy Development, to support their development. In the longer term, Entergy is focusing its attention on high-temperature gas reactors “with much broader applications beyond electricity,” Keuter says.

Keuter stated that HTGR technology on the reactor side is fairly well-known, and Entergy is part of an alliance of industry partners working with the US Department of Energy on HTGR, as part of the Next Generation Nuclear Plant (NGNP) project. Members of the alliance include refiners and reactor manufacturers Westinghouse, Pebble Bed Modular Reactor (Pty), General Atomics and Areva.

“If we were only interested in electricity, we wouldn’t be pursuing HTGR. Hydrogen production is of interest, in particular, because hydrogen has lots of potential to be used in fuel cells, that are the power supply in transportation and other applications,” Keuter continued.

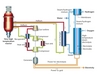

There are three main processes under investigation for producing hydrogen utilising nuclear energy. These processes include thermochemical water-splitting processes: sulphur-iodine, hybrid sulphur, and high-temperature electrolysis. All three processes need heat in excess of 750C to be economical, Keuter says.

One of the main issues of concern, from a licensing and regulatory standpoint, for a facility that produces hydrogen, is the proximity of such production to nuclear power plants and the risk of explosion. Keuter counters that Entergy’s Waterford 3 plant in south Louisiana is surrounded by petroleum plants. The experience at Waterford 3 has successfully demonstrated that nuclear power plants co-located such industrial facilities can be safely operated.

The profitability of the hydrogen production depends on the demand price of the energy commodity used in production. Profits are maximised when supply costs are low and demand prices are high. Entergy participated in a study to compare estimated costs of production of electricity, hydrogen and process heat utilising an HTGR with natural gas.

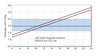

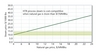

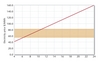

Graphs below compare the cost of producing hydrogen, electricity and process steam using either natural gas in SMR (diagonal line) or uranium in an HTGR (band).

The estimated cost of production is dependent on the cost of the fuel used to produce these products. Although both natural gas and enriched uranium spot and term prices vary, this study only looked at variation in natural gas prices. Uranium prices are generally more stable, and represent a small fraction of the total cost of energy.

A best-estimate cost for H2 produced with an HTGR is just under $3 per kilogram. This cost may actually decrease depending on actual HTGR capital costs which are becoming better defined as the technology development matures.

This study by the Idaho National Laboratory (INL) indicates that H2 production utilising a HTGR can become competitive with Steam Methane Reforming (SMR), the primary or most prevalent process used for H2 production world-wide, when natural gas costs approach $8 per million Btu (MMBtu). The price of H2 produced by SMR is directly related to the price of natural gas, which over the recent years has been volatile and often exceeded $8/MMBtu.

The study also compared the cost of high temperature steam production. It indicates that the cost of process heat or steam using an HTGR can be competitive with steam produced by firing natural gas when natural gas is the in the range of $4-7/MMBtu. Over the past several years, natural gas prices have often exceeded this range. The study assumed $1000/kWe equivalent for natural gas, $2900-$4100 kWe equivalent for an HTGR. It also assumed electricity and steam conditions of 400MWe, 1Mlb/hr stm, 2400psi and 1000F.

The results of the study have shifted Entergy’s development emphasis, Keuter says. “Originally when we were looking at HTGRs, we focused on electricity and hydrogen production. After the analysis, we have seen that process heat is even more economical.”

The company also worked with Idaho National Laboratory to assess the market for process heat in North America. It was determined that a substantial market exists for process heat in the range of 700°C-750°C, within the capability of an HTGR. This market assessment indicates the potential for deployment of about 150 HTGR modules at industrial petrochemical facilities, about 100 HTGR modules at fertilizer factories, over 200 HTGR modules in oil sands production, and more than 100 HTGR modules in coal-to-liquids conversion facilities. “Today if we had the HTGR facilities producing high-temperature process heat that could replace natural gas, there would be huge demand.”

Keuter noted that since the economics of process heat production with an HTGR are more competitive than its application in hydrogen production or electricity generation, Entergy is focusing on the process heat production application first. “Utilising an HTGR in the supply of process heat to industrial processes is very similar to its application in hydrogen production and we hope to demonstrate this capability in the NGNP project,” Keuter said.

Keuter estimates that more than one process might even be possible with the same reactor. “One of the things we are looking at with process heat is, depending on demand, switching from process heat production to electricity production and eventually, hydrogen production.”

“I think what might happen is that we look to develop a reactor with an intermediate heat exchanger that has the ability to produce any of the three – process heat, hydrogen, electricity – and leverage the three of them to economic advantage.

Dow Chemical is talking about having four HTGR units in one of the plants, whose primary usage would be process heat, but it wants to make sure that, as a backup, it can also produce electricity.”

Dow has joined up with Entergy to encourage the Department of Energy and US Congress to continue to develop the very high temperature reactor design that is part of the Next Generation Nuclear Plant initiative. The NGNP programme is scheduled to build and licence a reactor design by 2021, according to the Energy Policy Act of 2005.

“The next step of the alliance is mainly to show industry interest in developing and deploying this technology. Studies need to show that the technology will be commercially viable in a variety of industrial applications. To support a project as far as licensing, the NRC is hesitant to move unless there is a potential customer,” said Keuter.

“Entergy has said it would consider being a surrogate owner/operator in an alliance project,” Keuter concluded. The alliance made up of refiners, manufacturers and this energy company, working together, are exploring the next generation of high temperature reactors.

Related ArticlesThe hydrogen reaction Launching hydrogen PBMR: hot or not? DOE announces $40 million in funding for NGNP PBMR considering change in product strategy